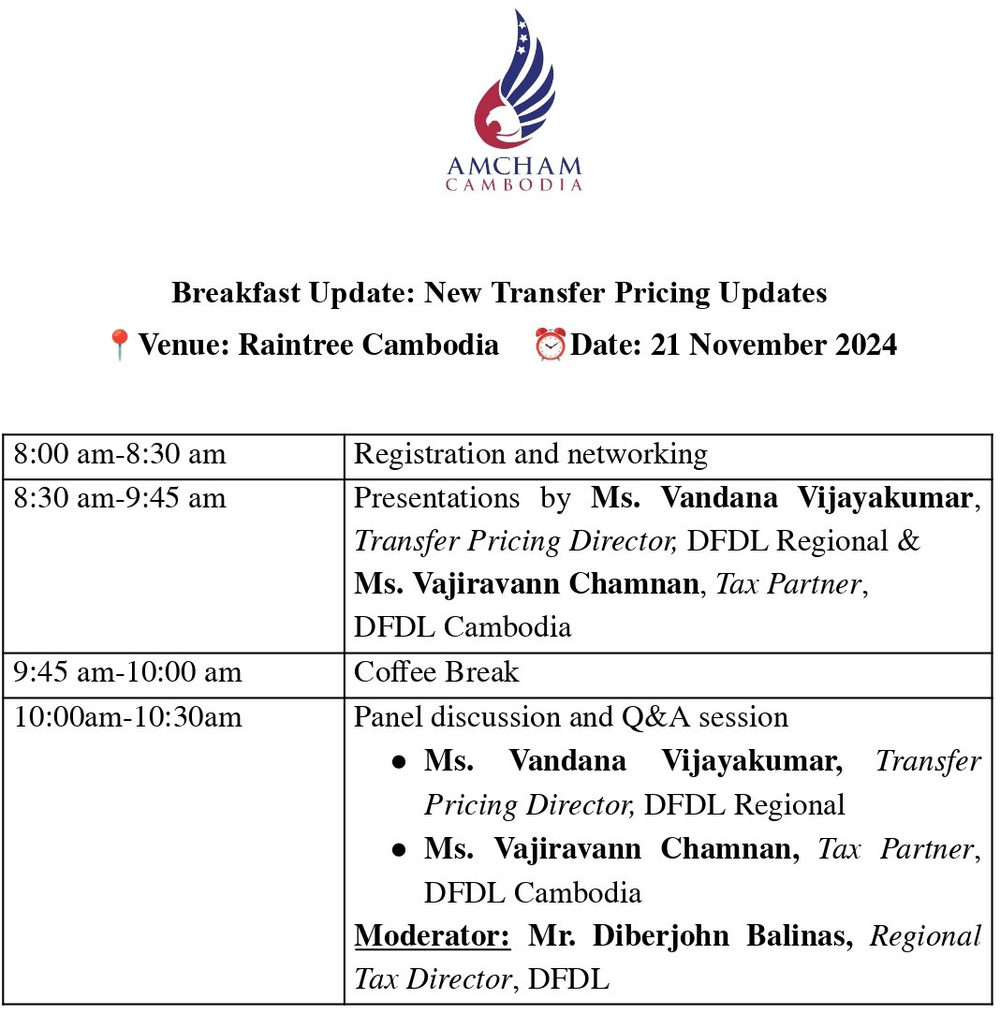

Event Details

Prakas 574 was enacted in September 2024 and provides key updates regarding transfer pricing compliance requirements in Cambodia.

Key Updates that will be discussed:

- New Transfer Pricing documentation requirements and exemptions

- Updates on related party loans

- Updates on Transfer Pricing adjustments

- Substance requirements for related party transactions

- Practical tips on tax audit updates for Transfer Pricing

- Updates on Permanent Establishment and income attribution

This session is ideal for professionals working in finance, tax, or compliance roles who need to stay updated on Cambodia's Transfer Pricing regulations. Don't miss this opportunity to understand Prakas 574 and its implications for your organization!

organization!

Thank you DFDL Cambodia for sponsoring this insightful event!

📅 Date: November 21, 2024

🕒 Time: 08:00 am - 10:30 am (Registration opens at 8:00 am)

📍 Venue: Raintree Cambodia

🎟 Free Entry (Seats are limited, and will be available on a first-come, first-served basis)